Trouble in Toyland 2022

Dangerous, recalled toys are easy to buy, U.S. PIRG Education Fund investigation shows. Our 37th annual report looks at the problems of recalls, counterfeits and not heeding warning labels.

Downloads

See the latest edition of this report

Trouble in Toyland 2023

Last month, Cheryl Robinson bought a small squeezable toy at a discount store near her home west of Columbus, Ohio. As soon as she took it out of the package, she was overwhelmed by a chemical smell. “I thought, ‘What in the world is that smell?’”

She said the smell was a cross between kerosene and paint. “It was so bad, my nose was burning,” she said.

Robinson uses these toys to help with her arthritis; she’s bought them before. She’s grateful she didn’t buy it as a gift for one of her great-grandchildren. For now, she’s storing the toy inside two Ziploc bags, while she waits to hear from the company or the store about what could be wrong with the toy.

Robinson may have alertly headed off something that could have made one of her great-grandchildren sick.

About 200,000 people go to an emergency room each year because of toy-related injuries or illnesses, according to the Consumer Product Safety Commission (CPSC). That number has been declining slightly over the last decade, but clearly, that number of injuries is unacceptable and is a call to action. This statistic doesn’t even count injuries that aren’t serious enough to warrant a trip to the emergency room.

For the 37th edition of Trouble in Toyland, we’re going to focus on three main areas of concern:

- Recalled toys that can still be purchased – brand new – days, weeks, months or years after they were deemed dangerous. During October, U.S. PIRG Education Fund purchased and received more than 30 recalled toys from U.S.-based online sellers, including Facebook Marketplace and eBay, as well as several online merchants.

- The role of parents and caregivers in keeping children safe because many injuries involve toys that haven’t been recalled and aren’t necessarily dangerous if played with as intended.

- Counterfeit toys that continue to infiltrate retailers’ shelves and online platforms, with many coming in from overseas. Counterfeit toys don’t necessarily meet mandatory U.S. safety standards.

In addition, we highlight ongoing hazards, particularly magnets and balloons, and tips for parents and gift givers. And we look at the emerging threat of toys with technology capable of invading our children’s privacy.

READ THE FULL TROUBLE IN TOYLAND REPORT

All toys sold in the United States (and intended for use by children 12 years or younger) must meet U.S. safety standards. And, by all indications, toys overall are safer today than in years past. Injuries and recalls are down, from 251,700 toy-related injuries in 2010 to 198,000 toy-related injuries in 2020.

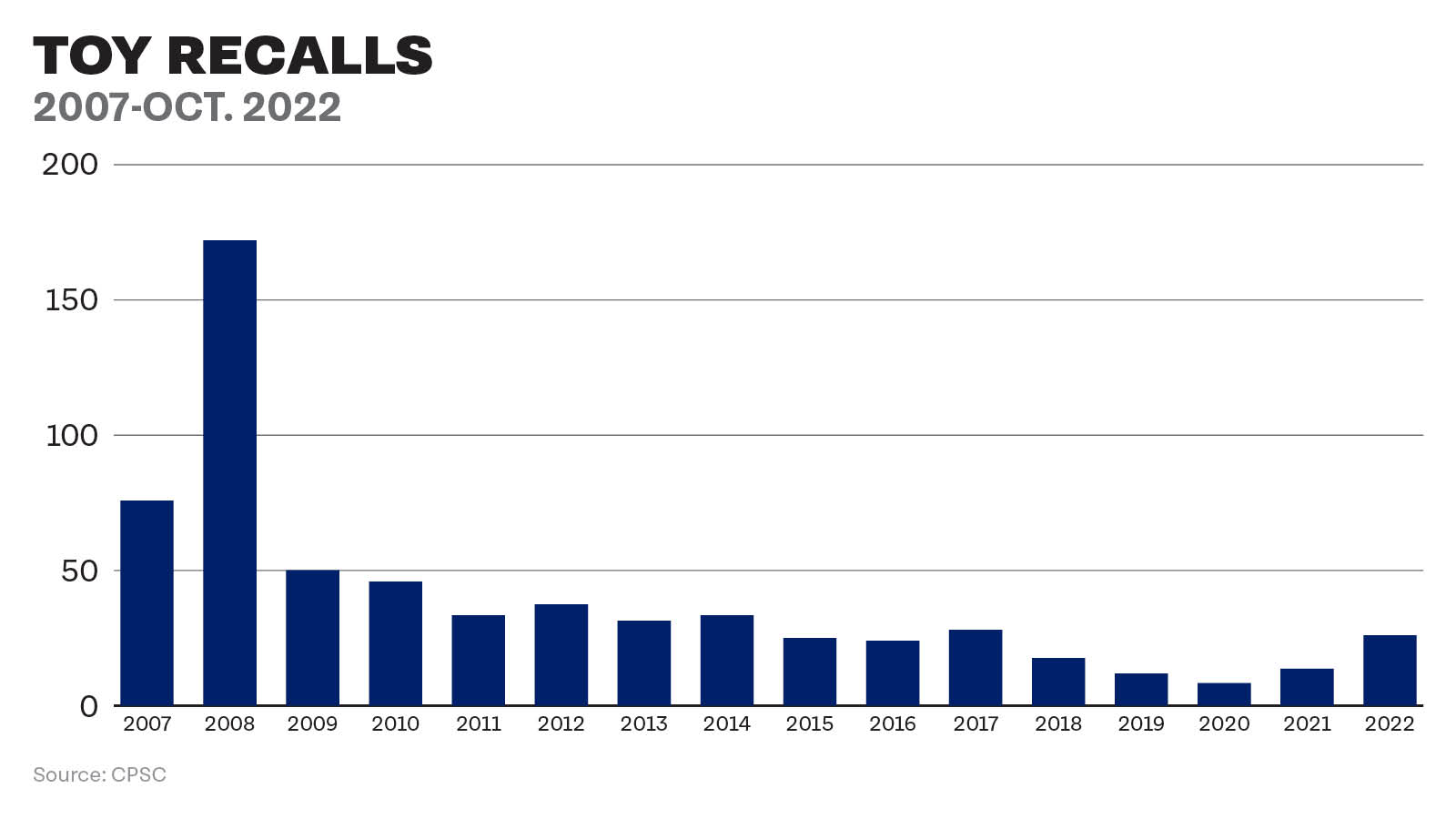

Toy recalls used to hit 50-plus a year more than a dozen years ago. We actually had 172 toy recalls in 2008. For the last seven years, they’ve ranged from nine to 28 per year. This year, recalls could top 30 for the first time since 2014.

Toy-related injuries treated in ERs in 2020:

- 198,000 injuries overall

- 9 deaths

- 40% of injuries involved children age 4 or younger

Injuries and illnesses occur when:

- Toys don’t meet standards, such as if they have parts that can easily be removed or fall off and be ingested.

- Children get access to a toy not meant for a child their age, such as a small bouncy ball or building blocks.

- Children use a toy in a way that wasn’t intended.

- Counterfeit toys are purchased, sometimes by shoppers who actually know they’re knockoffs.

- Toys violate our children’s privacy.

Everyone – retailers, toy manufacturers, regulators, lawmakers, consumer advocates and families – needs to do more to protect children.

Toys are safe until they’re not

All toys sold in the United States must meet U.S. safety standards. This must be documented with testing by the manufacturer. “All toys intended for use by children 12 years of age and under must be third-party tested and be certified in a Children’s Product Certificate as compliant to the federal toy safety standard enacted by Congress,” the CPSC says, “and to other applicable requirements as well.

The standards differ for different age groups, with a major focus on toys that are unsafe for children less than 3 years old because they contain small parts and pose a choking risk. Children age 4 and younger consistently make up about half of all injuries to children 14 and younger that require emergency room care. The overall standards are aimed at protecting children from toys that could cause choking, poisoning, cuts, burns, bruises, broken bones or internal injuries.

Toys often are recalled because a piece can become detached or break easily and pose a choking hazard. Others can break and create a sharp object that could cut a child. Still others contain toxics such as lead or phthalates.

WATCH OUR NOV. 17, 2022, NEWS CONFERENCE WITH THE CPSC, A SENATOR, AN ER DOCTOR, A TOY EXECUTIVE AND A CHILD SAFETY ADVOCATE

When the CPSC and a toy manufacturer announce a recall, that means the toy is supposed to be removed from store shelves and online marketplaces immediately. Consumers are instructed to take the toy away from children and contact the company for a refund or remedy. Recalls are issued when a dangerous defect has been discovered, sometimes after an injury has already occurred.

Recalled toys aren’t supposed to be available for sale. “Federal law prohibits any person from selling products subject to a Commission ordered recall or a voluntary recall undertaken in consultation with the CPSC,” according to the CPSC. In addition, it says, “It is illegal to resell or attempt to resell a recalled consumer product.” This applies to all recalled products, not just toys. Just three months ago, for example, the CPSC said The TJX Companies Inc. agreed to pay a $13 million civil penalty “for selling, offering for sale, and distributing previously recalled consumer products.” The products included recalled Fisher-Price Rock ‘n Play Sleepers and Kids II Rocking Sleepers, both of which have been linked to babies’ deaths by suffocation.

Despite the law, recalled toys are sometimes sold on primary or secondary markets.

In fact, during October, U.S. PIRG Education Fund purchased and received 11 different types of recalled toys from U.S.-based online sellers, including Facebook Marketplace and eBay, as well as several online toy shops. The toys included stuffed animals, action figures, activity balls for infants, musical toys, bath toys and a toddler’s riding toy. We purchased multiples of some toys, for a total of more than 30 recalled toys. The vast majority were new in the box or new with tags.

Among 26 listings of recalled toys from Jan. 1 through Oct. 31, we tried to buy 16 of them. We successfully bought eight, sometimes in multiples. (We didn’t try to buy huge toys that would be expensive to ship or toys with only a handful of items recalled.)

For some toys, we combed the internet and found only one that we could buy. For others, we found several. And for one toy recalled in June, we found dozens for sale. We bought and received 13 of them.

The reasons the toys we purchased had been recalled ranged from choking hazards to laceration risk to potential poisoning.

Toy safety tips for parents and caregivers

How were we able to easily buy toys that aren’t allowed to be sold?

“We are aware of the growing challenges with these kinds of ecommerce sites,” the CPSC told U.S. PIRG Education Fund. In the past year, the CPSC expanded its eCommerce, Surveillance, Analysis, Field, and Enforcement (eSAFE) Team and made more than 54,000 internet site takedown requests. The expansion helped the CPSC take “appropriate enforcement actions to address hazardous products on eCommerce platforms.”

“The high number of recalled products,” Dev Gowda, assistant director of Kids In Danger, told U.S. PIRG Education Fund, “not only shows that the CPSC is actively looking for unsafe products, but also that there are more dangerous products available for sale – including children’s products recalled for lead — a toxic substance banned since the 1970s.

In some cases in years past, merchants would improperly dispose of recalled toys by selling them to dollar stores, liquidation firms and thrift shops.

Still, it’s a big problem on a variety of sites. With one of the nation’s largest platforms, Facebook Marketplace, CPSC Chairman Alex Hoehn-Saric in July sent a letter to Facebook/Meta CEO Mark Zuckerberg, calling on the company to do more to monitor and prevent the dangerous items from ever being for sale. “This would save lives and prevent needless injuries,” Hoehn-Saric wrote.

The letter noted that the number of banned and recalled products offered for sale on Facebook Marketplace, as identified by the CPSC, has increased significantly over the past several years.

“While Facebook is just one player in the online consumer product resale market,” Hoehn-Saric wrote, “it makes up a growing proportion of CPSC’s take down requests.” In fiscal year 2020, about half of CPSC’s takedown requests were made to Facebook Marketplace. To date in FY22, that jumped to about 75 percent.

The role of parents

Many parents would likely take a dangerous, recalled toy away from their children, if they knew about the problem. But in order for toys to be recalled, they have to be for sale. That means that toys that were once believed safe actually weren’t safe at all. It just took a while for the problem to be discovered, either through testing, use or after a child got hurt.

That’s where parents and caregivers come in, especially around gift-giving times. Whenever a child gets a new toy, a parent should inspect the toy thoroughly, said Dr. Jerri Rose, associate division chief of pediatric emergency medicine, UH-Rainbow Babies & Children’s Hospital in Cleveland.

Things to consider, she said:

- Are there small parts that can break off that the child could put in their mouth? A small part is defined by the CPSC as any object that fits completely into a test cylinder 1.25 wide by 2.25 inches long. This is about the size of the fully expanded throat of a child less than 3 years old.

- Could a piece of plastic or another part of the toy break easily and produce something sharp that could cut the child or poke an eye?

- Look at the label on the box or package. “Toys that are approved should say the age they’re approved for,” Rose said.

- Look for labeling that says non-toxic.

- Make sure that anything that’s electric says it’s UL-approved.

- If there are batteries, especially button batteries, make sure the compartments are secure and can’t be opened by a young child. Screws could come loose during shipping.

- Is your child old enough to play with the toy responsibly? Just because a child is older than 3 doesn’t mean he can automatically be trusted to not put small parts in his mouth. Parents know their children best.

“There are a lot of toys out there that are perfectly safe for the appropriate age child,” Rose said, noting it can be challenging when a family includes children across a range of ages.

Just because a toy is for sale doesn’t mean it’s safe:

- It could have a defect and may be recalled in the future

- It could be counterfeit

- It could be inappropriate for all children in your home

The CPSC urges parents to choose age appropriate toys that match the child’s interests and abilities. And parents should always read and heed the safety warnings, information and labels.

Just about any toy can cause harm if used improperly or by someone too young.

“U.S. toy safety standards are among the toughest in the world,” Joan Lawrence, The Toy Association’s “Toy Safety Mom” and senior vice president of standards and regulatory affairs, told U.S. PIRG Education Fund, “and U.S. toymakers are committed to ensuring the safety of the toys they produce.

“That said, safety is a responsibility shared by industry and consumers. It is equally important that parents and caregivers take an active role in ensuring the safety of children by choosing age-appropriate toys for their kids and supervising play.”

Recommendations

- Congress should pass the INFORM Consumers Act, which was introduced last year. The goal: Stop sales of stolen, counterfeit or dangerous consumer products, including toys. The Integrity, Notification, and Fairness in Online Retail Marketplaces Act would require online merchants to collect, verify and disclose certain information from high-volume, third-party sellers.

- Toy manufacturers should make a commitment to do a better job of adhering to existing toy safety standards and improving testing.

- Merchants, both brick-and-mortar stores and online platforms, should do more to prevent recalled toys and counterfeit/knockoff toys from being sold.

- The CPSC should step up enforcement and impose meaningful penalties against merchants that sell counterfeit or recalled toys.

- The CPSC should continue to research the risks of phthalates and other toxics. “We’ve passed strong rules to keep lead and phthalates out of toys,” Trumka said.

”We should pass more strong rules to protect kids from other hazards. The problem is, there are more toxic chemicals out there than we know about,” he said. “It should be incumbent on companies not to use chemicals in products unless they know they’re safe. But until they fix the problem themselves, CPSC will be here to hold them accountable.” - Other battery manufacturers should consider making “bitter batteries,” as Duracell does, by coating button or coin-sized batteries with a foul-tasting substance to discourage children from putting them in their mouth or swallowing them.

Topics

Authors

Teresa Murray

Consumer Watchdog, U.S. PIRG Education Fund

Teresa directs the Consumer Watchdog office, which looks out for consumers’ health, safety and financial security. Previously, she worked as a journalist covering consumer issues and personal finance for two decades for Ohio’s largest daily newspaper. She received dozens of state and national journalism awards, including Best Columnist in Ohio, a National Headliner Award for coverage of the 2008-09 financial crisis, and a journalism public service award for exposing improper billing practices by Verizon that affected 15 million customers nationwide. Teresa and her husband live in Greater Cleveland and have two sons. She enjoys biking, house projects and music, and serves on her church missions team and stewardship board.

Find Out More

Food for Thought 2024

Is Alexa always listening? How to protect your data from Amazon

Safe At Home in 2024?