What I decided to do after shopping for long-term care insurance

Before listening to In Case You Get Hit By a Bus, I didn’t know about insurance that covers the costs of long-term care, such as home health care or nursing home care, for people who need assistance with daily living activities.

Before listening to In Case You Get Hit By a Bus, I didn’t know about insurance that covers the costs of long-term care, such as home health care or nursing home care, for people who need assistance with daily living activities.

Illnesses, injuries and other health problems that force you to need that type of assistance can occur at any age. And it could be difficult to pay for such care without accumulated retirement savings.

We all know health care isn’t cheap. But check out these annual median costs in 2020: $54,912 for a home health aide and $93,072 for a semiprivate room in a nursing home. Making the costs even more daunting, neither regular health insurance or Medicare covers long-term care. Medicaid only kicks in if you’re down to your last $2,000 in most states.

As a geriatric millennial, I was interested in insurance to cover (or at least soften the blow of) these costs should I ever need LTC services — not just during retirement but before it, too. When I looked into long-term care (LTC) insurance, it seemed geared toward people closer to their traditional retirement years. That makes sense, as people turning 65 years old have a nearly 70 percent chance of needing long-term care services at some point over the remainder of their lives.

But oddly, despite life expectancy rising until the COVID-19 pandemic, the number of LTC policies in the marketplace has fallen. It turns out that LTC insurers badly miscalculated the projected costs of care, resulting in premium hikes and an exodus by insurance companies from the LTC insurance market.

After shopping around, I decided against a stand-alone LTC insurance policy and instead bought a life insurance policy with a “long-term care rider” that will allow me to use my death benefit towards LTC services.

Since I already have a term life insurance policy, I’m using this policy solely as insurance against LTC costs should I ever incur them. This workaround gives me similar coverage, it’s just under a different name.

Photo from Flickr, Public Domain.

Topics

Authors

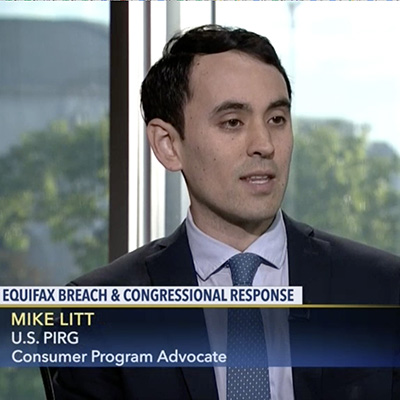

Mike Litt

Director, Consumer Campaign, U.S. PIRG Education Fund

Mike directs U.S. PIRG’s national campaign to protect consumers on Wall Street and in the financial marketplace by defending the Consumer Financial Protection Bureau, and works for stronger privacy protections and corporate accountability in the wake of the Equifax data breach. Mike lives in Washington, D.C.

Find Out More

U.S. food regulators allow most food additives, but could that change?

Laundry pods: 8.2 million bags recalled because they can open easily, poison children

New water beads warning: Some contain cancer-causing toxin