Big Banks, Big Overdraft Fees

(Updated 19 December 2016)

Overdraft fees are a major source of consumer pain, since they are borne disproportionately by Americans with few financial resources. Through the first three quarters of 2016, 626 large banks reported collecting $8.4 billion in revenue from overdraft and NSF fees, an increase of 3.6 percent over the same period in 2015. American consumers should look to the Consumer Financial Protection Bureau (CFPB), which has already enforced overdraft regulations and returned millions of dollars to consumers, to take new action to prevent unfair overdraft fees. Here is our latest report, based on new data reported to the government by big banks.

Downloads

Executive Summary

Overdraft fees are a major source of consumer pain, since they are borne disproportionately by Americans with few financial resources.

Since 2015, the Federal Financial Institutions Examination Council (FFIEC) has required banks with more than $1 billion in assets to report revenue from overdraft-related service charges, a category that also includes nonsufficient funds (NSF) charges (or fees for bounced checks). According to the Center for Responsible Lending, U.S. consumers paid $17 billion in overdraft and NSF fees in 2015, which amounts to $53 for every American.

Through the first three quarters of 2016, 626 large banks reported collecting $8.4 billion in revenue from overdraft and NSF fees, an increase of 3.6 percent over the same period in 2015. American consumers should look to the Consumer Financial Protection Bureau (CFPB), which has already enforced overdraft regulations and returned millions of dollars to consumers, to take new action to prevent unfair overdraft fees.

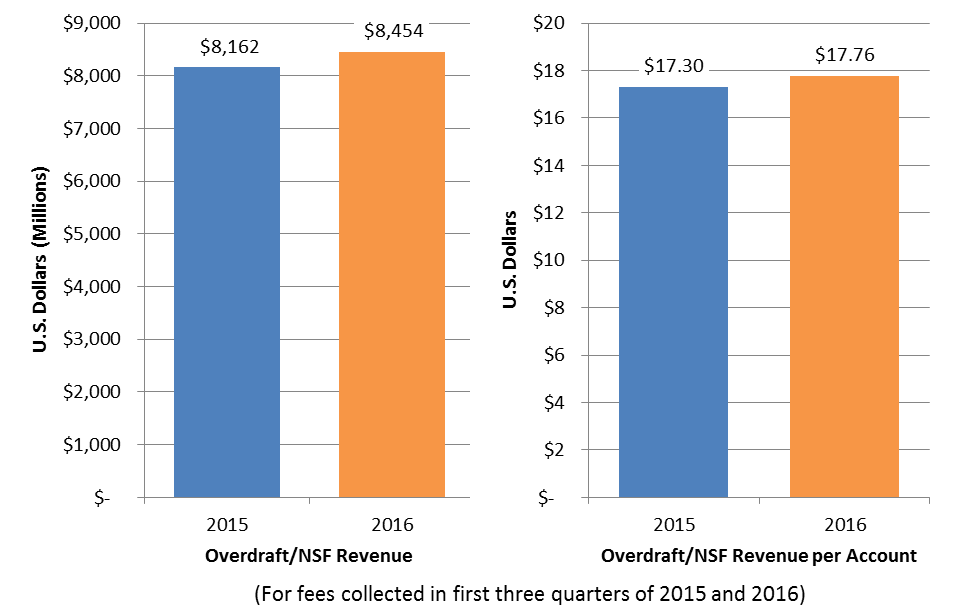

Reported overdraft and non-sufficient fund (NSF) revenue per account is on the rise.

- The average bank collected $17.76 in overdraft/NSF fee revenue per consumer deposit account in the first three quarters of 2016, an increase of 2.6 percent over the same period in 2015.

- In the first three quarters of 2016, overdraft/NSF fee revenue accounted for an average of 8.1 percent of reporting banks’ net income, unchanged from the same period in 2015.

Figure ES-1. In the First Three Quarters of 2016 Banks Increased Total Overdraft/NSF Revenue and Revenue per Account

Ten banks account for 67 percent of reported overdraft/NSF revenue. These banks include both some of the nation’s largest banks, as well as smaller banks that are unusually reliant on overdraft/NSF fee revenue.

- The 10 banks that collected the most overdraft revenue through the first three quarters of 2016, in order, were: Chase Bank, Wells Fargo, Bank of America, TD Bank, U.S. Bank, PNC Bank, Suntrust Bank, Regions Bank, Branch Banking and Trust, and Woodforest National Bank.

- These 10 banks primarily consist of large national consumer banks, which could be expected to collect the most overdraft revenue. Woodforest Bank is the notable exception, with less than a fifth the number of total deposit accounts of any other Top 10 bank.

Many banks with the highest overdraft revenue per account rely heavily on overdraft revenue.

- The 10 banks that collected the most overdraft/NSF revenue per account through the first three quarters of 2016, in order, were: Ameris Bank (based in Georgia), ACNB Bank (Pennsylvania), Armed Forces Bank (Kansas), Woodforest National Bank (Texas), BankPlus (Mississippi), First National Bank Texas – First Convenience Bank (Texas), Ocean Bank (Florida), Planters Bank (Mississippi), Gate City Bank (North Dakota), and First Community Bank (Virginia).

- These banks collected an average of $98 in overdraft revenue per non-retirement deposit account, more than five times the national average. Five of the ten banks would have seen a net income loss in the first three quarters of 2016 without overdraft revenue.

Banks supervised by the CFPB collect less overdraft fee revenue per account. Since 2011, banks with more than $10 billion have been supervised directly by the CFPB, a federal agency created for the sole purpose of protecting consumers in the financial marketplace.

In the first three quarters of 2016, 94 banks under CFPB supervision that reported fee revenue collected $17.27 in overdraft revenue per account, compared to $21.36 per account for the 532 other banks that reported revenue. There are likely factors beyond CFPB supervision that could account for this difference. Nevertheless, lower revenue per account at large banks suggests that the CFPB’s supervisory program is helping protect consumers from unfair overdraft fees.

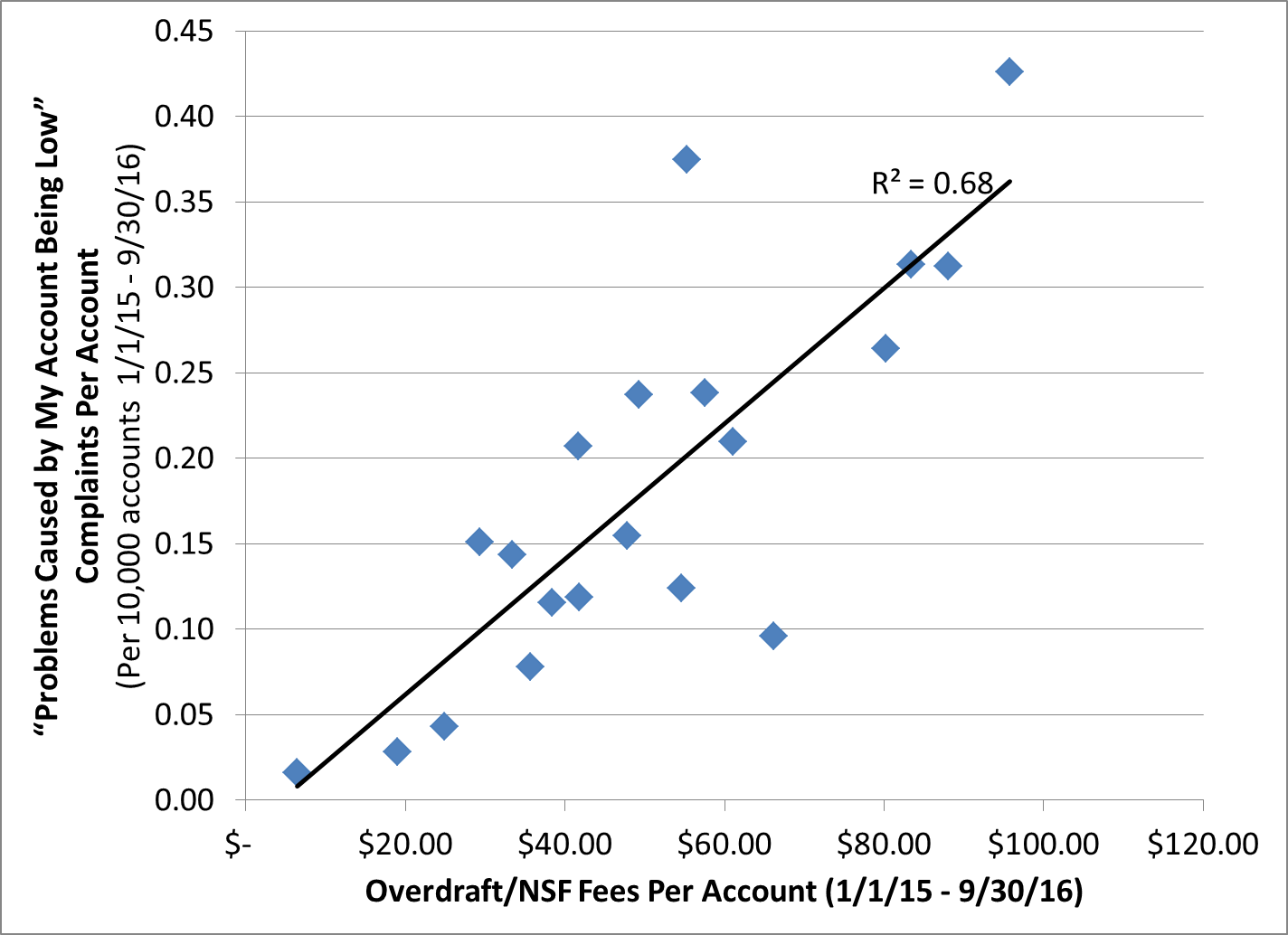

CFPB data reveals a positive correlation between overdraft/NSF revenue per account and complaints per account.

The CFPB allows consumers to file complaints about banks. An analysis of bank complaints about “Problems related to my funds being low” reveals a positive correlation (R2 = 0.68) between number of complaints per account, and overdraft/NSF revenue per account. For this analysis, both complaints and overdraft fees are from the period January 1, 2015, to September 30, 2016, the longest period for which overdraft fee data is available.

Complaints per bank likely depend on a number of factors, including the customer base of each bank. However, this relationship suggests that fees per account and complaints per account may be useful indicators for finding bank mistreatment of customers. This relationship also supports the Federal Deposit Insurance Corporation’s assertion that high overdraft fees may harm public opinion of banks, posing a “reputational risk.”

Fig ES-2. Banks with More Overdraft/NSF Fee Revenue Generally See More Consumer Complaints, Per Account (Among Banks with More than 100 CFPB Complaints for “Problems Caused by My Account Being Low”)

The Consumer Financial Protection Bureau (CFPB) is working to protect consumers from unfair overdraft fees, including by enforcing existing regulations, requiring banks to return money to consumers that was collected unfairly, and urging banks to offer low-risk accounts designed to help consumers avoid overdraft fees.

The CFPB should continue its efforts to protect consumers, including by seeking a ban on the bank practice of reordering account transactions to maximize revenue. Federal policymakers should defend the CFPB against attempts to eliminate it, and should continue to ensure the CFPB has the resources, independence, and tools at its disposal to effectively protect consumers from overdraft fees, as well as from other predatory financial behavior.

Topics

Find Out More

What the California Consumer Privacy Act means for you

Online privacy tips by state